Is Zakat Due On Hajj Savings? – Everything You Need To Know

Hajj and Zakat are two of the most significant of the five pillars of Islam. Prophet Muhammad (PBUH) has said, “Alternate Hajj and Umrah because both rid one of poverty and sins just as the blacksmith’s bellows remove all the impurities from metals like iron, gold, and silver. The reward for Hajj mabroor [accepted] is nothing short of Paradise.” (At-Tirmidhi)

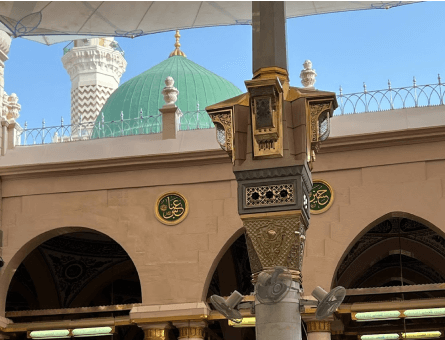

Every year, thousands of Muslims worldwide save money to fulfil the Hajj obligation and visit the Holy Kaaba in Makkah, Saudi Arabia. Therefore, like other Zakatable savings, Allah SWT has directed the Muslim community to give Zakat (2.5% of the amount) even on Hajj savings if it reaches the value of Nisab and one Hijri year has passed while it’s been in your possession.

Hence, Zakat on Hajj savings should be given until you use that money to perform the obligation of Hajj. Here is everything you need to know about Zakat on Hajj savings.

What Is Zakat?

As narrated in Bukhari “Bunyal Islam ala Khamsin,” Prophet Muhammad (PBUH) once said that the religion of Islam is built upon five pillars (things). These pillars uphold the faith, one of which is Zakat (the third pillar of Islam).

As narrated in Bukhari “Bunyal Islam ala Khamsin,” Prophet Muhammad (PBUH) once said that the religion of Islam is built upon five pillars (things). These pillars uphold the faith, one of which is Zakat (the third pillar of Islam).

Zakat is an Arabic word that means to purify, increase, and grow. It is the Islamic form of charity to help the underprivileged. The primary purpose behind Zakat is not to decrease one’s wealth but to increase and purify their savings.

Typically, the value of Zakat amounts to 2.5% of a Muslim’s annual savings. The Messenger (PBUH) of Allah SWT said, “Charity never decreases wealth.” (Muslim)

Not only this, but Zakat also purifies one’s heart against selfishness, ensuring that the poor community is protected against poverty and hunger. Even though most people have a common misconception of Zakat as a form of Islamic tax, please note that it’s a spiritual obligation for which the person will be directly accountable to Allah SWT.

“You shall observe the Salah, give the obligatory charity (Zakat), and bow down with those who bow down.” [Holy Quran 2:43]

“There are seven types of people who can receive Zakat: the poor, the needy, those in debt, those in the cause of Allah, recent reverts to Islam, those distributing Zakat, wayfarers, and those in captivity.” [Holy Quran, 9:60]

When Is Zakat Due in 2024?

Being a yearly obligatory alms on Muslims’ wealth, Zakat is due once a lunar year on the amount of wealth an individual owns. This can be in the form of money, jewellery, land, livestock, and any other thing that one can earn a profit from. Even though one can pay Zakat any time of the year, it is recommended to give Zakat during the holy month of Ramadan.

So, if your wealth has surpassed the amount of Nisab by the third Ashra of Ramadan and you have managed to maintain the wealth for 12 lunar months, then you must pay Zakat on the wealth in the second Ashra of the very next Ramadan.

3 Conditions of Zakat

Here are three conditions that you must fulfil in order to be eligible to give Zakat:

Value of Nisab – Minimum Quantity

For one to be eligible to pay Zakat, they must fulfil two conditions; have a sound mind and possess the minimum amount of Nisab (wealth) for one lunar year. According to Sharia, Nisab is 2.5% of a Muslim’s annual savings.

However, the amount of Nisab varies depending upon the type of asset that you own. For example, the Nisab by the silver standard is 612.36 grams (21 ounces), and the Nisab by the gold standard is 87.84 grams (3 ounces).

Lapse of a Lunar Year

In order for one’s wealth to be eligible for Zakat, note that it should be under their ownership for one year (12 months of the Hijri calendar) at least.

In order for one’s wealth to be eligible for Zakat, note that it should be under their ownership for one year (12 months of the Hijri calendar) at least.

Even though you can pay Zakat in advance (even by years), one should calculate the amount of Zakat from the year their wealth surpasses the Nisab value until the next twelve months of ownership.

Growth

In reference to Zakat, growth has two different meanings. Firstly, it is used to define an asset that is itself produced by growth either by acquisition or as a gain, such as livestock or crops. Growth here also describes an asset that provides the owner material benefit or profit.

However, this doesn’t mean that one has to pay Zakat on the assets they own and use like vehicles, furniture, clothing, books, etc, but you should give Zakat on the fraction of surplus growth, such as a farmer is supposed to pay Zakat on the crops harvested and not on the remaining yield.

Do You Pay Zakat on Savings Less Than a Year?

All kinds of savings, regardless of the purpose they are kept for, are Zakat-applicable. However, there are two conditions to this; the wealth should pass the value of Nisab, and an entire year should have passed since the last payment of Zakat, meaning that the savings should have been in your ownership for more than twelve months.

Therefore, the answer to the question is “No,” you do not have to pay Zakat on savings for less than a year.

Does my wife have to pay zakat on gold she owns?

The one-word answer to this is “Yes.” If your wife owns gold equivalent to 7.5 tolas (87.48 grams), you must pay Zakat on it, which is 2.5% of the value of gold. However, the gold should be held for more than a (lunar) year.

When calculating zakat, it is always safer to round up from the exact value calculated, to avoid underpaying zakat due on wealth that one may not be aware they have, like loose cash.

Summary – Zakat on Hajj Savings

Whether you have saved money for Hajj, for your child’s tuition, or to buy a house or car, note that all savings are Zakatable. However, your savings must fulfil two conditions: the amount of savings should pass the minimum value of Nisab, and it should be under your ownership for at least one lunar year.

In simpler words, if you have saved money for Hajj, then as long as it is in your bank account, you must pay Zakat on it, which is 2.5% of the amount. On the other hand, if you have deposited the money to the agency, then no Zakat is applicable on the savings as they aren’t under your direct ownership.

Explore The New Pilgrim App

The Ultimate App

for Hajj and Umrah!